From property damage to certain lawsuits against you it s essential whether you make a living renting multiple properties or you re an accidental landlord renting the home you just moved out of and can t sell.

Does progressive renters insurance cover storage units.

What is it and when you need it.

Covered items on your renters policy include furniture clothes electronics and more.

Self storage companies that do offer property insurance will outsource it to an insurance carrier so you may have to pay your premiums and file claims with that carrier instead of the storage company.

Homeowners insurance also covers personal property in a storage unit in the same way that renters insurance does.

If you have a policy covering 50 000 you would be insured up to 5 000 for the items in your storage unit.

Most policies will also compensate you for any temporary living expenses if your rental unit or home is damaged in a storm or fire.

Landlord insurance is for you if you have rental properties or tenants.

What does renters insurance cover.

How much does renters insurance cover for self storage units.

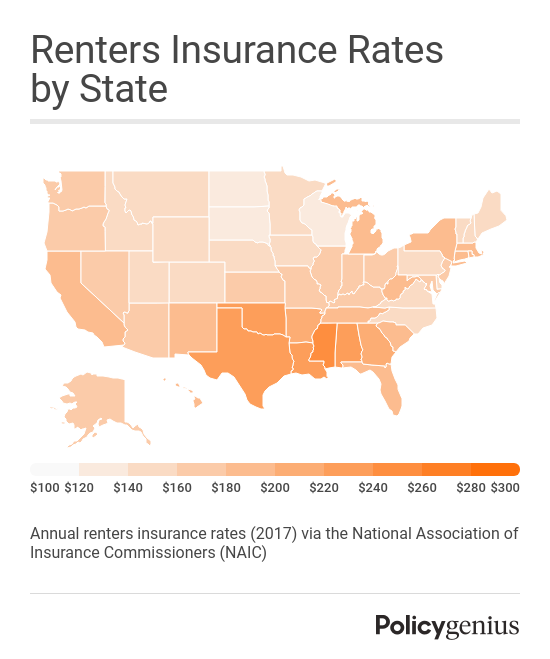

The amount will vary by insurer and is usually around 10 of your personal property liability limit.

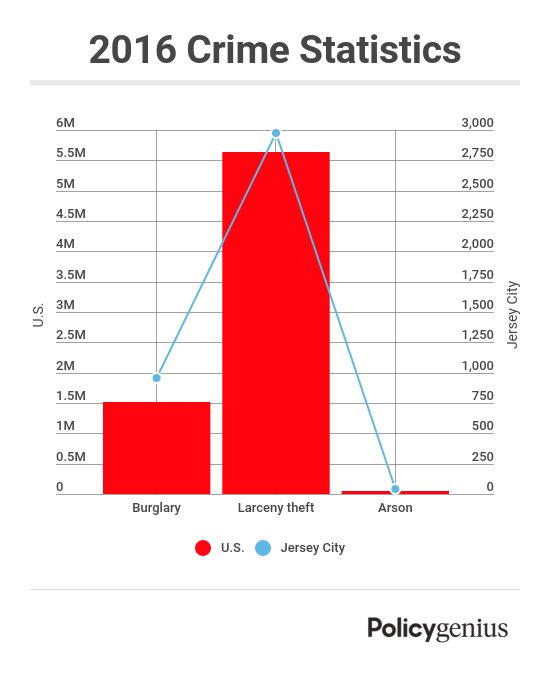

Does renters insurance cover theft.

Storage unit coverage bought directly through the storage company usually covers less than storage insurance that comes with homeowners or renters insurance through your own provider.

Insurance coverage for property stored in storage units isn t as common as other forms of insurance but most reputable storage facilities will have access to a tenant insurance program so the customer.

Personal property coverage on your renters insurance policy can cover your belongings if they re damaged or stolen up to specified limits and minus your deductible.

You re protected against fires weather and water damage theft vandalism and other incidents listed on your policy.

If they don t separate insurance coverage is necessary.

Renters insurance also typically covers items stolen from vehicles storage units or while traveling.

Renters insurance will cover items in a self storage container up to 10 of your policy limits.

Some homeowners and renters insurance policies will cover items stored off site.

Many storage unit operators will ask you to provide proof of insurance.

It also covers you in case you re liable for someone else s injuries in your home.

Consider what you re using the storage unit for and whether you ll need to have access to what you ll be.

Renters insurance provides financial reimbursement for covered losses to your personal belongings.

As an example your provider may offer a coverage limit of 30 000 while the storage facility s coverage may max out at 5 000.

Your homeowners or renters insurance may include coverage for your stored possessions.