This agreement is outlined by your utility s net metering policy which sets the rates at which interconnected solar customers buy and sell electricity.

Do bill credits for solar panels ever get paid.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

Grid tie solar system owners receive credit for sending electricity into the public utility grid.

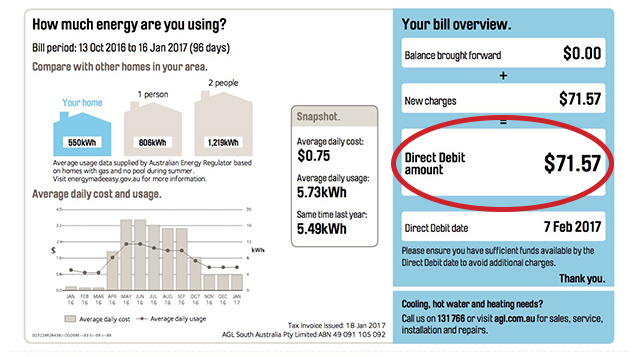

With a net metering agreement you get credit for that excess electricity usually as a kwh credit that will show up on your next month s bill or as a total sum at the end of the year.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Filing requirements for solar credits.

If you use gas your solar panels won t cover the gas portion of your utility usage so you ll still need to pay for that as usual.

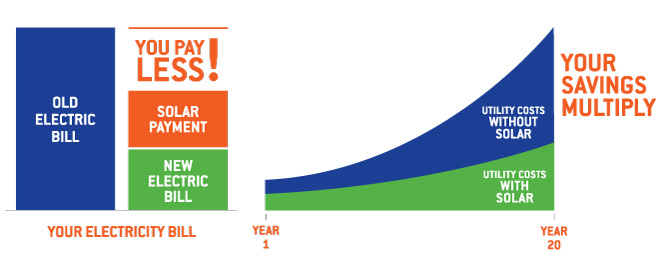

These savings depend on factors like the size of your solar panel system your energy consumption and your local utility rates.

The higher your bill the more likely you ll benefit from switching.

You ll pay the bill annually although you may receive a quarterly or monthly statement that breaks down your usage and credits.

You calculate the credit on the form and then enter the result on your 1040.

After installing solar feel good supporting a sustainable clean environment by comparing your previous year s electric bill with your new solar panel bill for the same month.

Solar panels generate their own power and can therefore greatly offset your monthly electricity bill if not eliminate it.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

After going solar the first thing you will likely notice is the drastic decrease in your monthly electric bill.

To claim the credit you must file irs form 5695 as part of your tax return.

When your solar panels produce more solar power than you use your solar energy system sends the excess solar energy to the grid.

They use those credits to offset their energy bill.